Do everything with just one link.

Create shortened URLs, unique biolink pages and get proper analytics of your visitors.

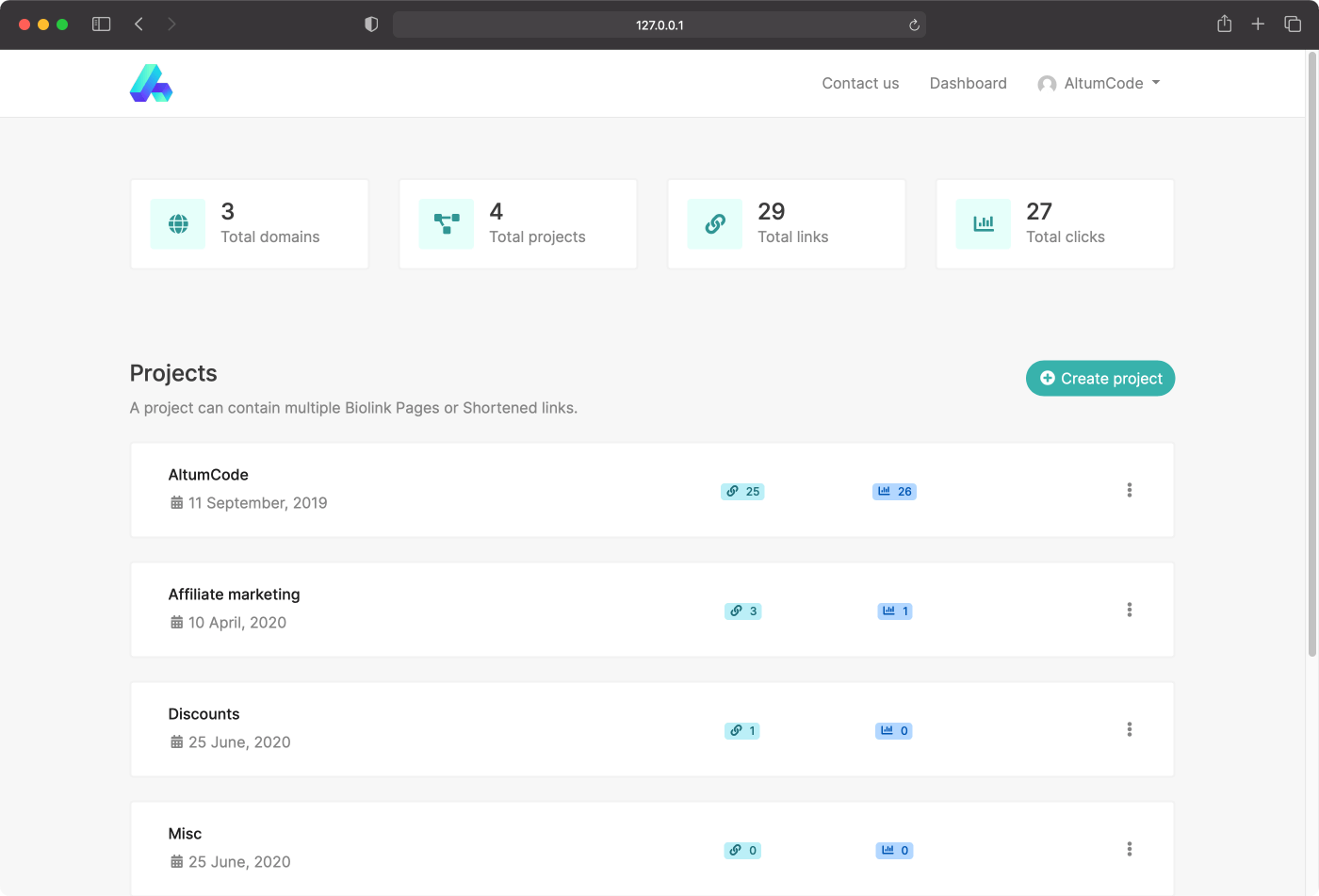

Unlimited projects

Easily manage all your links with the use of Projects.

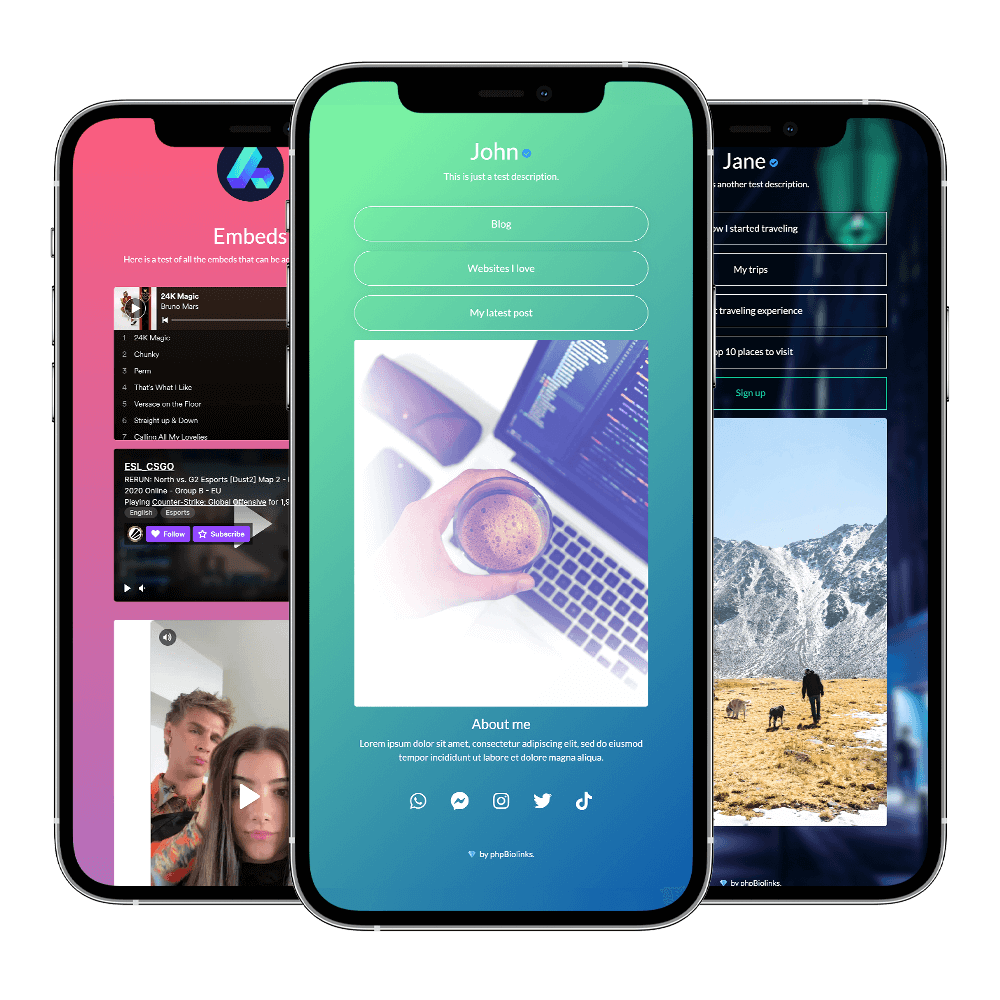

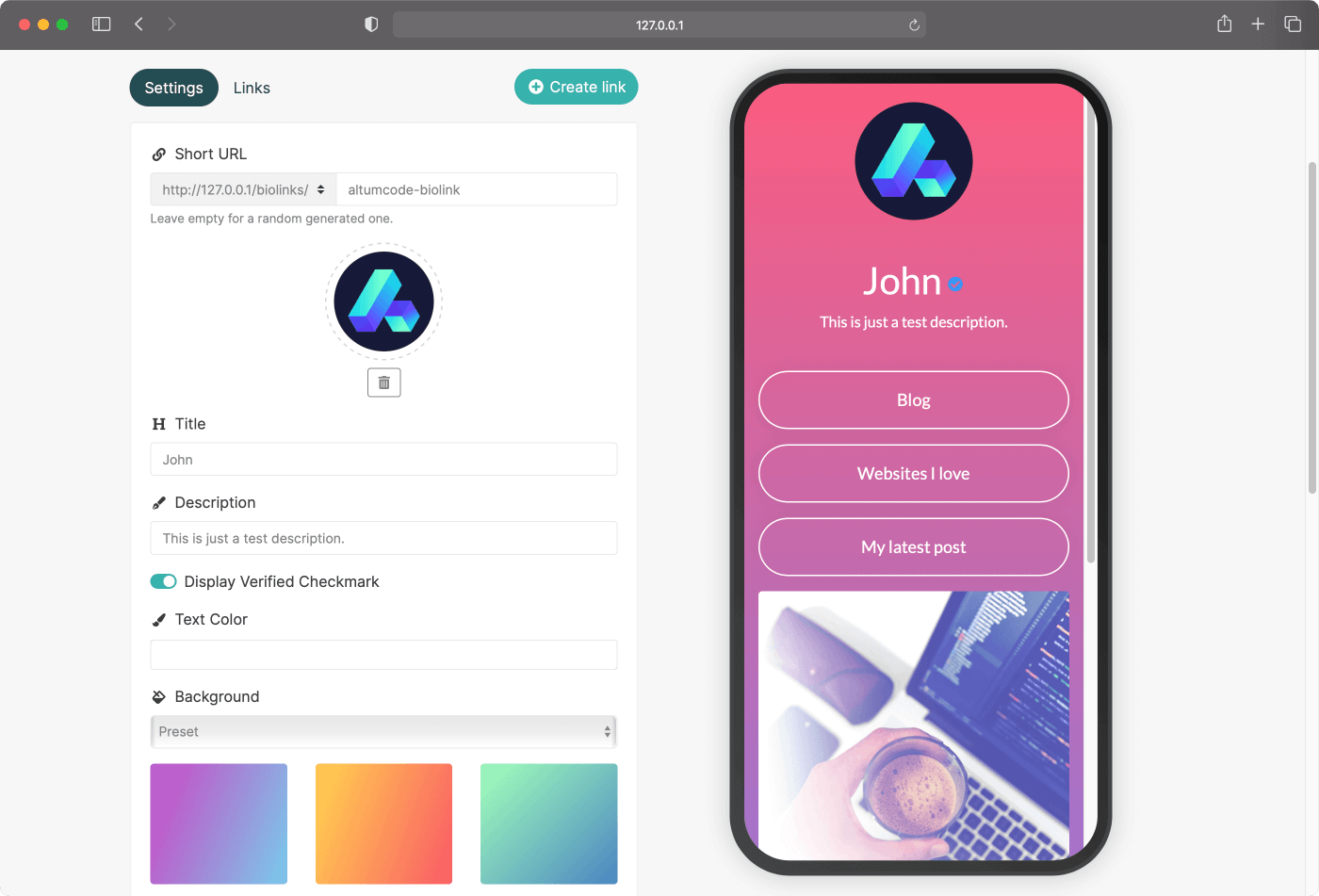

Biolink pages

Create your own & unique biolink page, a ton of easy to use settings and implementations.

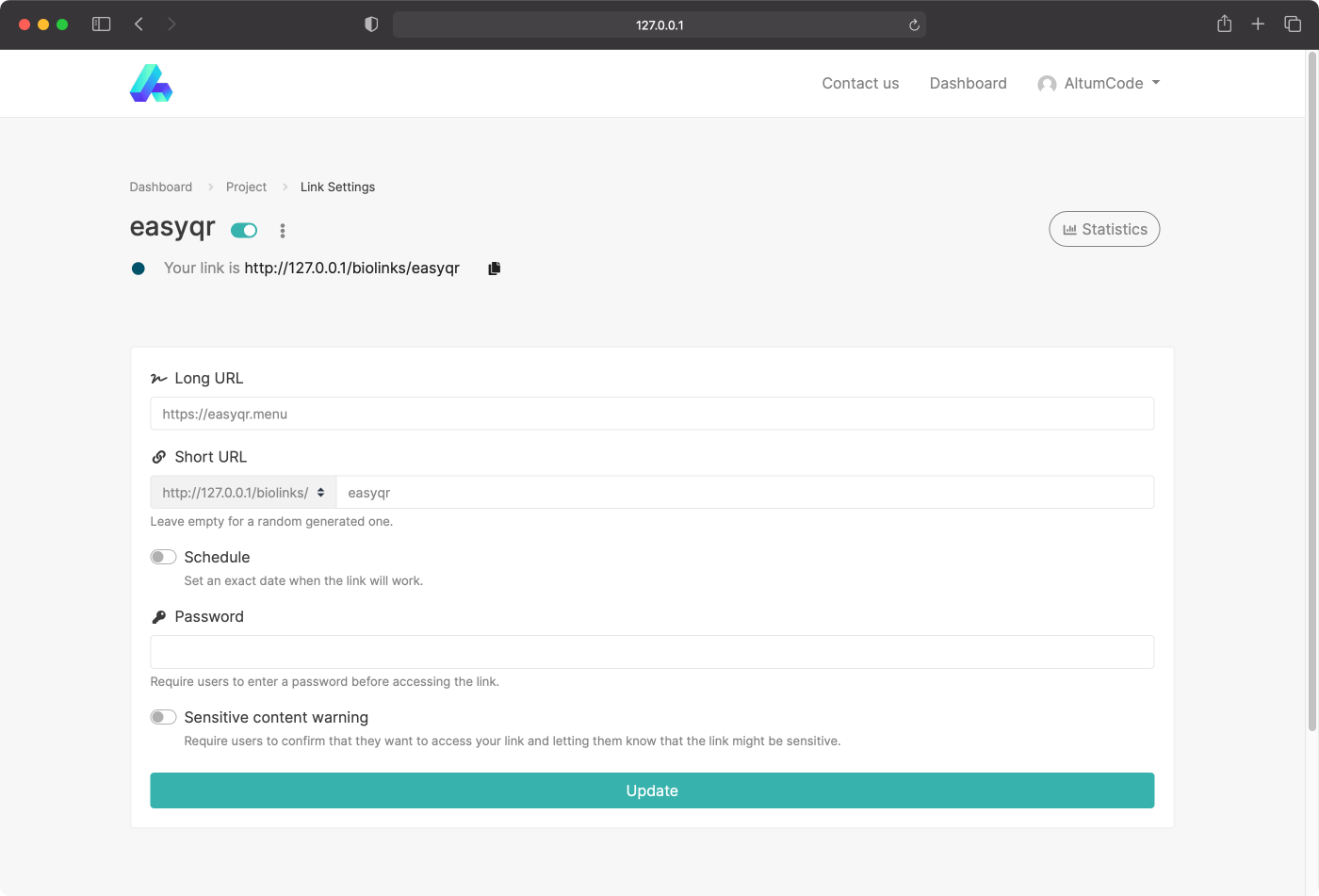

Shortened links

Yes! You can use our service as a shortener as well.

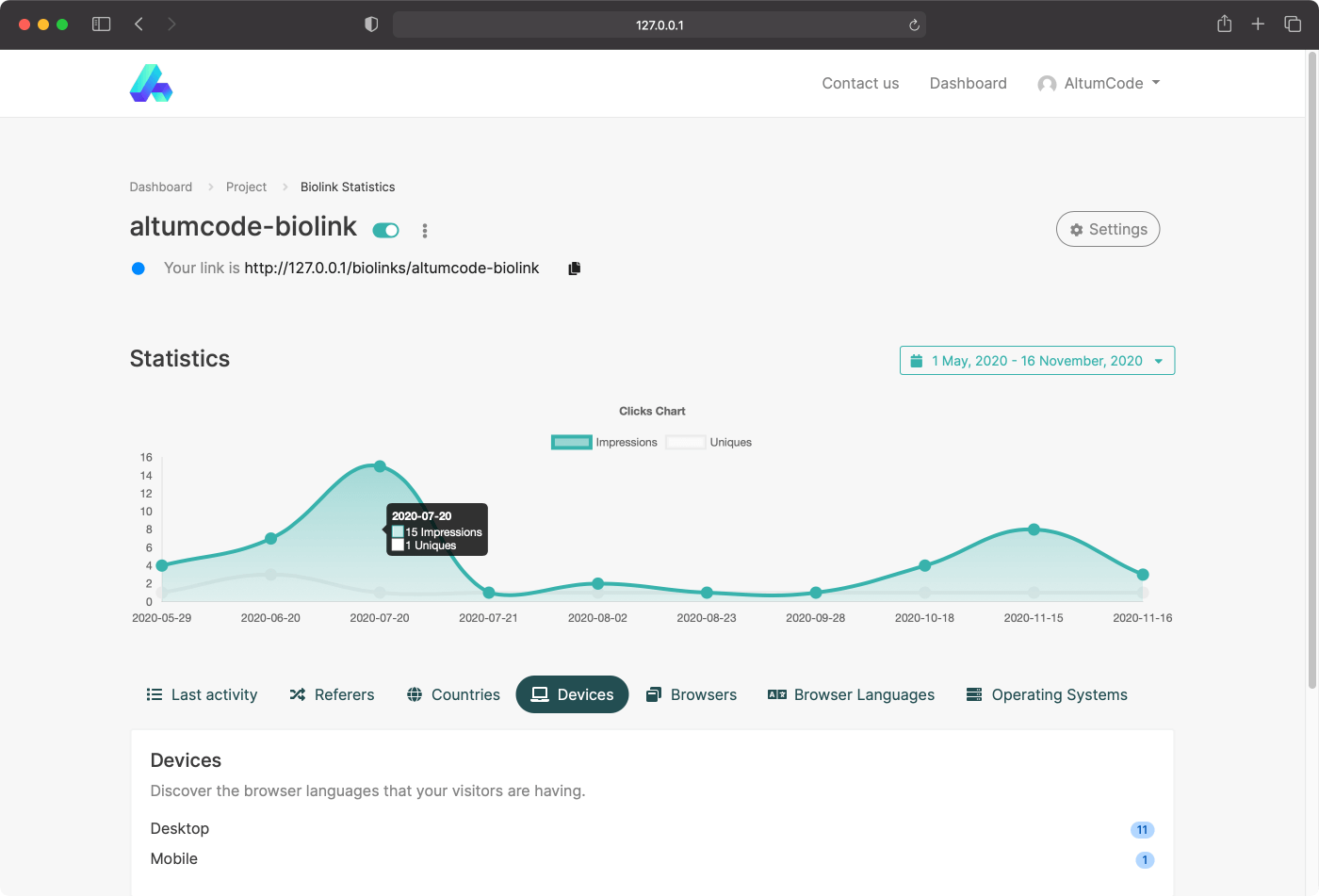

Built-in analytics

Day by day analytics, referrers, countries, operating systems, languages and many more.

Choose your plan

Choose and get your plan based on your needs.

Free

Free

-

10 Projects

-

10 Pixels

-

15 Biolink Pages

-

25 Shortened Links

-

20 Enabled Biolink Blocks

-

1 Custom Domains

-

Additional Global Domains

-

Custom Back-half

-

Deep linking

-

Removable branding

-

Custom branding

-

Custom colors

-

Indepth Statistics

-

Custom Backgrounds

-

Verified Checkmark

-

Links scheduling & limiter

-

SEO Features

-

UTM Parameters

-

Social links

-

Extra Fonts

-

Password protection

-

Sensitive content

-

Leap link

-

No Ads

-

API access